Believe it or not, taxes for bloggers are pretty straightforward and easy to manage.

I use a combination of practical tax tips for bloggers (informed by my CPA), paired with just a small handful of useful, free and inexpensive tax tools to manage all of the tax implications of running my blog business. It’s not difficult to learn how to do taxes on your blog income—and we’re going to walk through all of my tax tips for bloggers here today.

By now, I’m assuming you’ve probably started a blog, began reaching your target audience, and figured out how to promote your content—and your blog is now beginning to make some money (or you’re planning for that outcome).

Now comes the responsibility that many small business owners in the blogging world dread—taxes for bloggers.

First, the answers to a few of the most pressing blog tax questions that readers have asked (click to expand each answer).

Do I need to pay taxes on my blog income?

Yes. If you’re earning any income from your blog, it qualifies as self-employed income under IRS guidelines. This applies whether or not you’re operating as a formal business entity (like a sole proprietorship, corporation or LLC) or just doing informal business and collecting some revenue.

What kinds of taxes do I need to pay on my blog income?

By operating a blog business, even part-time, you’re self-employed. As a self-employed individual, you’re required to (1) file an annual tax return and (2) pay estimated taxes each quarter. We go into these two subjects in much more detail throughout this guide. On top of your blog income tax, self-employed individuals are also responsible for paying self-employment tax (SE tax). SE tax covers the costs of Social Security and Medicare, which is a corresponding tax equivalent that’s withheld from your employees’ paychecks.

How do I calculate the taxes I owe on my blog income?

If your blog earned anything, you’ll have to pay taxes on that income. More specifically, you’ll have to file an income tax return if your net earnings from self-employment are $400 or more. If your net earnings from self-employment were under $400, you’ll still have to file an income tax return if you meet any other filing requirements (and you probably do).

Before determining if you’re subject to self-employment tax and income tax, calculate your net profit or net loss. Do this by subtracting your business expenses from your business income. Here’s the equation for determining your taxable blog income:

Total Blog Income – Total Blog Expenses = Net Income (or Net Loss)

You can usually deduct some or all of your losses from your income on your tax return, which helps reduce or eliminate taxes. The IRS has a more detailed tax guide for self-employed individuals to calculate their tax liabilities.

Disclosure: This article should not be considered tax or legal advice, as I am not a tax professional or attorney. These are simply my best practices for how I personally handle the taxes in my own blogging business, which has been shaped by consultation with my CPA. Please consult with a CPA or attorney to get advice specific to your business.

In this guide, I’m going to share all of my own best practices about managing taxes for bloggers. And don’t worry, even if you’re not a “numbers person,” this process isn’t as painful as you might imagine.

Taxes for Bloggers 101: How to Do Taxes on Your Blog Income (Blog Tax Tips)

- Define What Kind of Blog Business You’re Operating

- Choose Which Legal Entity to File Your Blog Taxes Under

- What is a 1099-MISC Tax Form (Taxes for Bloggers)?

- Keep Thorough Records For Your Upcoming Blog Taxes

- Use Tax Deductions to Your Advantage as a Blogger

- Understanding Estimated Taxes (Paying Quarterly Estimates)

- The 3 Best Tools to Use in Managing Your Taxes for Bloggers

Disclosure: I’m big on transparency, so please know that some of the links below are affiliate links and at no additional cost to you, I may earn a commission if you purchase one of the tools I mention. Know that I only recommend products I’ve personally used and believe are genuinely helpful, not because of the small commissions I make if you decide to use them.

Now let’s get into my ultimate guide to taxes for bloggers.

Want My Free Blog Business Plan Template?

Grab my free blog business plan template in both Google Doc and PDF format (that’s helped me build a six-figure blog) and reach 500,000+ monthly readers today.

"*" indicates required fields

1. Define What Kind of Blog Business You’re Operating

What kind of blog are you running? There are three stages of blogging that we’ll discuss in this section:

- Hobby Bloggers (blogging solely for fun or as a creative outlet)

- Side Hustle Bloggers (blogging on the side of your day job to slowly grow)

- Full-Time Bloggers (blogging as your main business)

Each stage here requires a slightly different take on how to practice bookkeeping and manage your taxes, but it’s important to remember that anytime you’re making money from your blog, you’ll almost certainly have to pay some taxes on that income.

Remember, you can get into hot water with the IRS if you’re neglecting part of your tax obligations and happen to be audited one day.

Tax Overview for Hobby Bloggers

A hobby blog exists primarily to share an interest, tell stories, or document your life. Making money may be a secondary consideration, but it isn’t your main concern.

In the beginning phases of blogging, it may feel difficult to differentiate between a hobby and a business. It’s common for blogs to make little to no profit for months (even years), so determining if you’re hobby blogging or business blogging is more about your mindset, approach and goals.

To transition your blog from a hobby into a business, you have to start treating it like a business.

Doing things like accurate bookkeeping to keep track of your blog’s expenses, formulating a proper blog business plan for how you’re going to grow, maintaining a regular schedule and keeping track of how much time you’ve spent working on your blog indicate that you’re running a business.

The IRS has more information to help you determine if your blog is a hobby or a business.

Here’s a major downside to hobby blogging—you can only deduct your expenses up to the amount of profit you make. So for example, if you purchased a $1,200 laptop to work on your blog, but only made $500 in profits for the year, your total deduction allowance is just $500.

If you’re running a more formalized blog business that has an official legal entity (even if it’s a part-time business), you can deduct all your business-related expenses each year.

Tax Overview for Side Hustle Bloggers (Schedule C)

A side hustle blog is very similar (from a tax perspective) to a full-time business blog, but it does require a little less work to manage.

If your main source of income is still a regular job or series of blogging jobs (that technically classify as freelance gigs) which add up to significantly more income than what your blog is generating today, your tax filing process will be pretty easy and straightforward. You should still think of your blog as a separate little business entity—keeping detailed records of all your income and related expenses.

If you’re the sole owner of your side blog, then you become a Sole Proprietor. Filing your blog taxes as a Sole Proprietor only requires you to attach a Schedule C to your Standard 1040 tax form.

In other words, if your blog is generating a relatively small proportion of your total annual income, you can file your blog taxes along with your personal tax return (on a Schedule C that details your blog-related income and expenses). You won’t need to file a separate tax return for a business entity.

Tax Overview for Full-Time Bloggers (Separate Business Entity)

As a full-time blogger, you’re all in. Your blog is your primary source of income and you spend most of your working hours growing and improving it.

At this stage, you’ll want to establish a formal legal entity to operate your blog business under—like an LLC for both the tax advantage and additional legal protections (more on that next).

When running a formal business, you’ll be expected to file:

- Your personal income tax return (as per usual)

- A separate business income tax return

- Self-employment taxes

- Payroll taxes (if you hire help to run your blog)

There are some notable exceptions—like the ability for single member LLCs to file taxes as an individual (making it the ideal business entity for established bloggers without employees) vs being taxed as a corporation that requires a separate business tax return. We’ll break this down in more detail below.

Lastly, it’s worth noting that as well as taking tax into account, there’s a lot more to consider when hiring your first employee. Being aware of broader HR requirements as your blogging business grows is crucial in this context.

2. Choose Which Legal Entity to File Your Blog Taxes Under

How you file your taxes for bloggers is highly dependent on which legal entity you choose to operate your blog business under.

You can run your blog using one of four types of different legal structures:

- Sole Proprietor

- S Corporations

- C Corporations

- Limited Liability Companies (LLC)

This guide on the Quickbooks blog has a more detailed explanation of each type of legal structure, but here are the basics you need to know.

Which business entity should I form to operate my full-time blog?

My personal opinion and experience is that a Limited Liability Company (LLC) is the best legal entity for full-time blogging. The primary benefits of forming an LLC to run your blog are that (1) you can’t be held personally liable for any debts your business incurs or any legal issues your business comes under and (2) your business income won’t be subject to double taxation. You have more protections and pay overall less in taxes with an LLC, compared to the other legal entities here. If your blog business has no full-time employees, you’ll be considered a single-member LLC, which dramatically simplifies your tax filing process too.

Now, let’s walk through some of the pros and cons of the various business entities (and how to choose the right one for you).

Sole Proprietorship

Sole Proprietors can continue to file their blog taxes directly on their personal tax forms (on a Schedule-C), making it a great, easy option for side hustle bloggers. However, this business entity is not advantageous once your business becomes the primary source of your total income. Operating a Sole Proprietorship comes with a higher risk profile—you personally assume responsibility for all financial and legal obligations.

Requirements vary by state and county, but all that’s likely required in order to set up a Sole Proprietorship, is to register it with your state and local governments.

S Corporation

An S Corporation allows individuals to report their income on their personal tax returns, which keeps things simple from a tax filing perspective. S Corporations are allowed to have up to 100 shareholders, making this a viable option to consider if you’re running your blog alongside others who want to have a stake in the business.

The main reason to consider registering as an S Corporation, as opposed to a C Corporation, is to avoid double taxation. This is when a business’s profits are taxed both on the business tax return, and again as personal income once profits are distributed to owners of the business. S Corporations are not subject to this double taxation.

C Corporation

A C Corporation is a corporation that’s recognized as a completely separate tax entity from the individual owner(s). When you file your taxes as a C Corp, you’ll be filing two separate tax returns—one for the business and one for your personal income. You will not attach a Schedule C to your personal taxes.

To be honest, a C Corp is generally unnecessary for a blogging business, but I’m including it for the sake of completeness. Those who benefit from this legal entity are much larger businesses with multiple employees who want to take advantage of fringe benefit deductions.

C Corps are open to an unlimited number of shareholders. They also have to pay taxes at the company level. Currently, there’s a flat 21% tax rate for C Corps, but they’re subject to double taxation—which as a solo blogger would translate into less take home income for you under this business entity.

Limited Liability Company (LLC)

An LLC is the most popular legal structure for blogging businesses to operate under.

With this structure, you’re not personally liable for business finances or legal issues—and you’re not subject to double taxation. While this business entity is very easy to set up, you have to pay an ongoing tax in order to operate.

This fee is different in each state, so do your research about your state’s requirements. For example, California has the highest cost to run an LLC—charging $70 to initially file and an $800 annual franchise tax in order to continue operating, whereas dozens of states have annual fees between $0 and $50.

Whatever structure you use for your blog business, you should open a separate bank account for all your business transactions. This helps a lot with bookkeeping and also gives you a clear idea of how much you’re making from your blog and how much you’re spending. As an aside, if you’re interested in average times to earning from a blog, check out my guide on how long it takes to make money blogging.

3. What is a 1099-MISC Tax Form (Taxes for Bloggers)?

Blogging income often comes from many different sources. Therefore, bloggers must report every source of income on their taxes.

If this is your first year blogging, you may wonder why you’re receiving 1099-MISC forms from the sponsors or affiliate companies you promote.

What exactly is a 1099-MISC tax form?

In an employer-employee relationship, you receive a W-2 at the end of the year, detailing your earnings, deductions and contributions for the year. As a self-employed blogger, you’ll receive a 1099-MISC from every company that either pays you. In case of a company like Stripe or PayPal that processes payments you accept for the sales of your own products and services, you’ll receive a 1099-K form.

What You Need to Know About 1099-MISC Tax Forms

A 1099-MISC form is a detailed statement of your earnings from a particular company (whether as an affiliate or contract worker).

You should receive a 1099-MISC from any affiliate company or client if you’ve made more than $600 from them throughout the year. Sometimes companies forget to send a 1099-MISC, but you’re still required to file those earnings as income on your own taxes. Bloggers who receive less than $600 are also required to report that income.

Do LLCs and Corporations Receive 1099 Forms?

If you’re structuring your blogging business as an S Corp or a C Corp (not very common), then you should not receive 1099 forms from other businesses come tax time.

If you formed an LLC to operate your blog under though, the answer is a bit nuanced. Most blog businesses (that aren’t too large) can be safely considered single-member LLCs that don’t have full-time employees, and rather opt to hire contractors for help with certain tasks. For single-member LLCs, you will need to receive a 1099-MISC form.

That being said, there is more than one way to file taxes as an LLC, and how you choose to file will determine whether or not you’ll need a 1099-MISC.

- People who file as a single-member LLC will receive a 1099-MISC form

- Some people opt to tax their LLCs as a corporation, which will not require 1099 forms

If you’re a solo run LLC, you’ll receive a 1099-MISC at the end of the year to use for filing the taxes on your blog.

4. Keep Thorough Records For Your Upcoming Blog Taxes

As a small business owner—even if your blog is a side business—you need to keep detailed records of all your blogging income and expenses.

This means you should record every source of income and expense you’ve acquired through your business.

Hands down, the easiest way to do that (in an automated fashion) is by using a blogger and small business-focused accounting tool like Sage 50cloud, which is a cloud-connected suite of tools that offers remote access, intelligent reporting on your finances and time-saving automation.

Another blogger-friendly accounting tool to consider is QuickBooks Self-Employed (which costs $15/mo, with first month free). QuickBooks can connect directly to your business bank (and credit card) accounts to automatically track transactions, categorize them, and create reports for your entire business behind the scenes without much work from you. It’s what I use to track my income and expenses and generate reports for my accountant.

Whether you’re using a tool like Sage 50cloud, or QuickBooks or not, smart financial management still means you should make a habit of:

- Saving your receipts (or taking photos of them)

- Keeping track of all your transactions

- Keeping a list of all your affiliates and all payments received from them

- Maintaining a list of your business expenses

- Writing down all profits and expenses in a timely manner

- Keeping (digital) proof of all transactions

- Maintaining a backup of your Quickbooks Online files

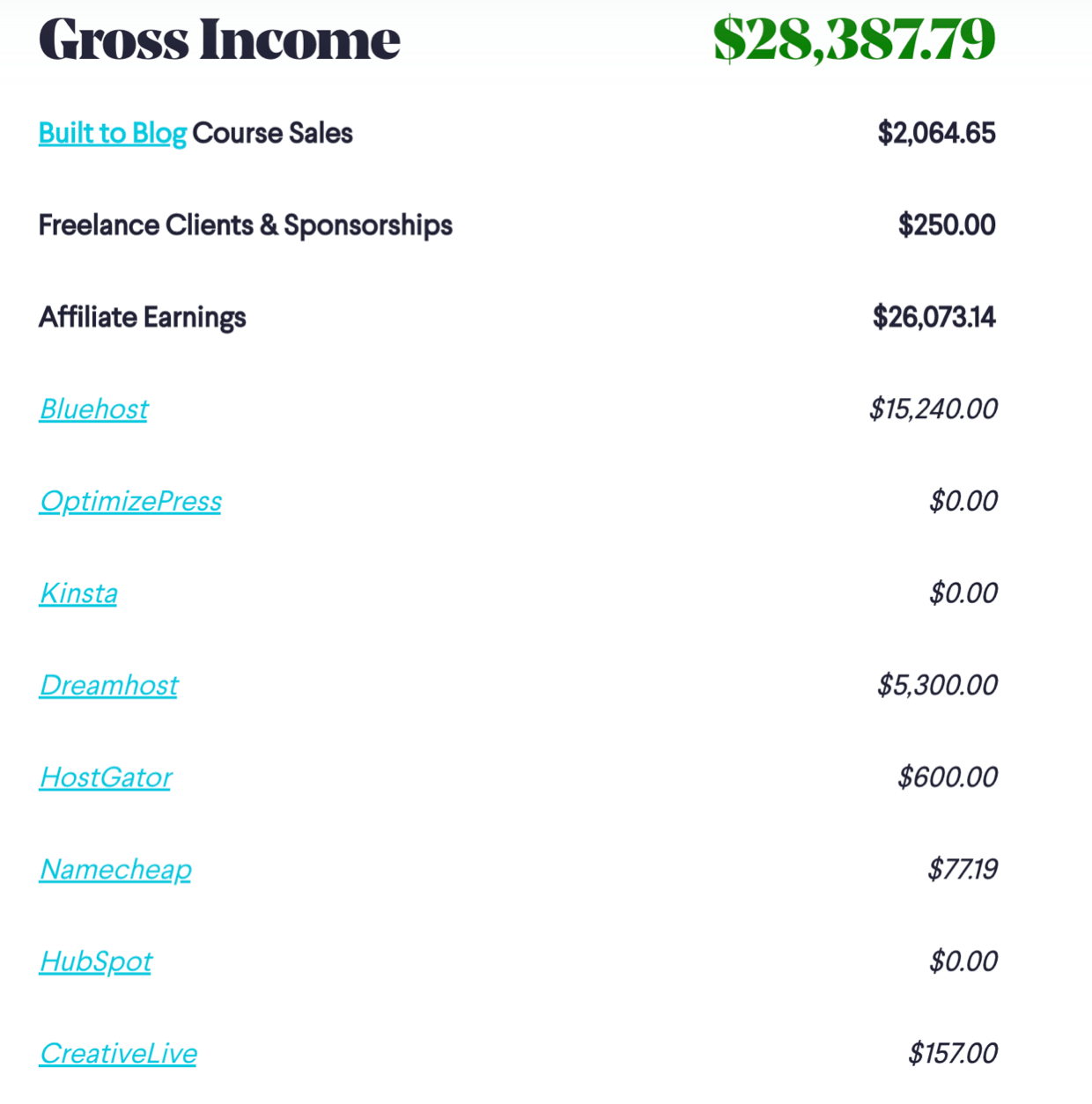

To show my readers that I practice what I preach here, each month, I publish a transparent blog income report to illustrate how much I spend and earn from blogging.

Here’s a quick snapshot of a few of the income sources that contribute to my blogging income each month:

While I have a wide range of earnings from different affiliates, they’re all relevant when it’s time to file my taxes.

Plus, every incremental source of income adds up over the course of a year—and by tracking which affiliate programs are growing (or paying out higher rates), it can tell me which types of blog post ideas I should prioritize writing about and the kinds of blog headlines that’ll likely convert best over the coming months (in order to promote higher-paying affiliate products).

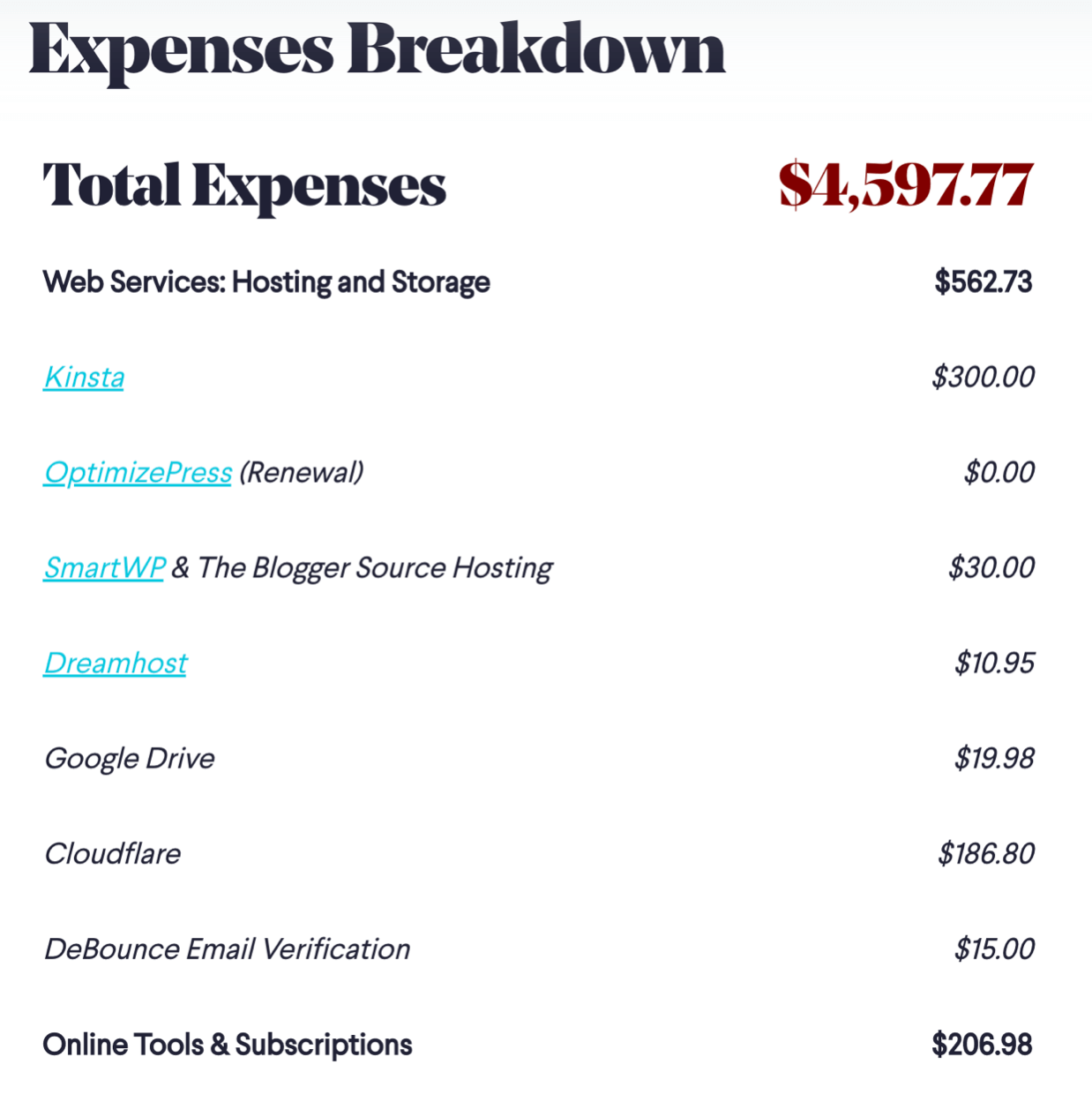

Here are some of my blog’s expenses broken down, too:

It’s important to keep a detailed record of expenses because:

- You want to know if your blog business is profitable. Account for every expense and source of income (to track your progress and make changes if things are trending downward).

- You also want to accurately account for your expenses (so that you can maximize your deductions on your tax return).

Next, we’re going to discuss how tax deductions work in regard to taxes for bloggers.

5. Use Tax Deductions to Your Advantage as a Blogger

In the context of your blog business, a tax deduction or “write-off” is a business expense that you count against (deduct from) your taxable income.

Keeping track of your expenses is a fundamental part of running a business. Each business expense has the potential to be deducted from your taxes.

Let’s say you made $100,000 in profit. If you had zero expenses, you would pay taxes on the full $100,000 that you made that year.

But it’s rare that any business has no upkeep costs. Almost every small (or large) business costs something to keep running.

Instead, let’s say that you made $100,000 in income, but your blog cost a total of $40,000 (in expenses) to run. Assuming all of those $40,000 in expenses are classified by the IRS as deductible, it means you can “write down” your taxable income to $60,000… reducing the amount of taxes you’ll pay at the end of the year.

To be fair, this is an over-simplified explanation and there are factors that can make this process more complicated. In theory, though, each business expense can potentially lower your taxable income.

What Can Bloggers Deduct From Their Taxes?

Not everything you spend money on is tax deductible—and being too loose with your deductions can land you in hot water with the IRS.

The IRS describes legitimate deductibles as both “ordinary and necessary.” That means that the expense must be common to your type of business and necessary for the work you’re doing.

Personal expenses cannot be deducted unless they’re also clearly used for your business. In this case, you can deduct part of it on your taxes. For instance, if you do most of your work at home, you may be able to deduct a portion of your utilities..

Here’s a starter list of the many blogger tax deductions (expenses) you can potentially write off on your blog taxes:

- Advertising and other blog promotion-related expenses

- A portion of household expenses if your office is in your home

- Office supplies

- Educational blogging courses, blogging books, or eBooks that help with your blog (educational deductions)

- Fees for your web hosting (even if you’re on a cheap hosting plan)

- Any tools for running your blog

- Professional services (like writing help, designers, and developers)

- Equipment and software (especially if purchased to test and write something like my Bluehost reviews analysis)

- Rent for an office space

- Meals and entertainment (for business purposes)

- Business-related travel (including Uber & Lyft rides)

When in doubt about whether a particular expense will qualify as deductible, I recommend getting in touch with a tax professional who can give you clear advice based on the specific circumstances and tax situation of your business.

If you need a CPA, my accountant Leo Leydon has 25+ years of experience and has been phenomenal in helping me safely maximize the tax deductions for my own blog business. I couldn’t recommend him more highly. 🙂

6. Understanding Estimated Taxes (Paying Quarterly Estimates)

Employees don’t have to worry about paying taxes throughout the year. This is done automatically for you by your employer (and taken out of your paycheck at each pay period).

Why Do Self-Employed People Need to Pay Estimated Quarterly Taxes?

If you’re self-employed or an independent contractor, you’re expected to pay a percentage of your income in the form of quarterly estimated taxes.

By paying your self-employed taxes as quarterly estimates (4 times throughout the year), the objective is to not owe any additional taxes once you file your annual tax return. The process of paying estimates spreads your tax liability throughout the year.

How Much in Taxes Do I Need to Pay Each Quarter?

Many experts recommend setting aside around 30-40% of your net income to put towards your tax burden.

Speaking from personal experience, if you’re married and filing a joint tax return, you’ll likely be closer to the 30% figure. If you file your tax return as single, plan on owing closer to 40% of your net income.

As you calculate the profits from your blog each month, set aside 30-40% of that income (in your business savings account) for tax purposes—most of which you’ll pay in the form of quarterly estimated tax throughout the tax year.

Paying Your Estimated Federal Quarterly Taxes

You’re not required to pay quarterly taxes on the federal level if you expect to owe less than $1,000 in taxes for the year (which isn’t likely if you’re here). If you’re filing your taxes as a corporation, though, you must pay taxes quarterly if you expect to owe more than $500 in annual taxes.

According to the IRS, “To calculate your estimated tax, you must figure your expected adjusted gross income, taxable income, taxes, deductions and credits for the year.”

Not exactly the most clear explanation, right?

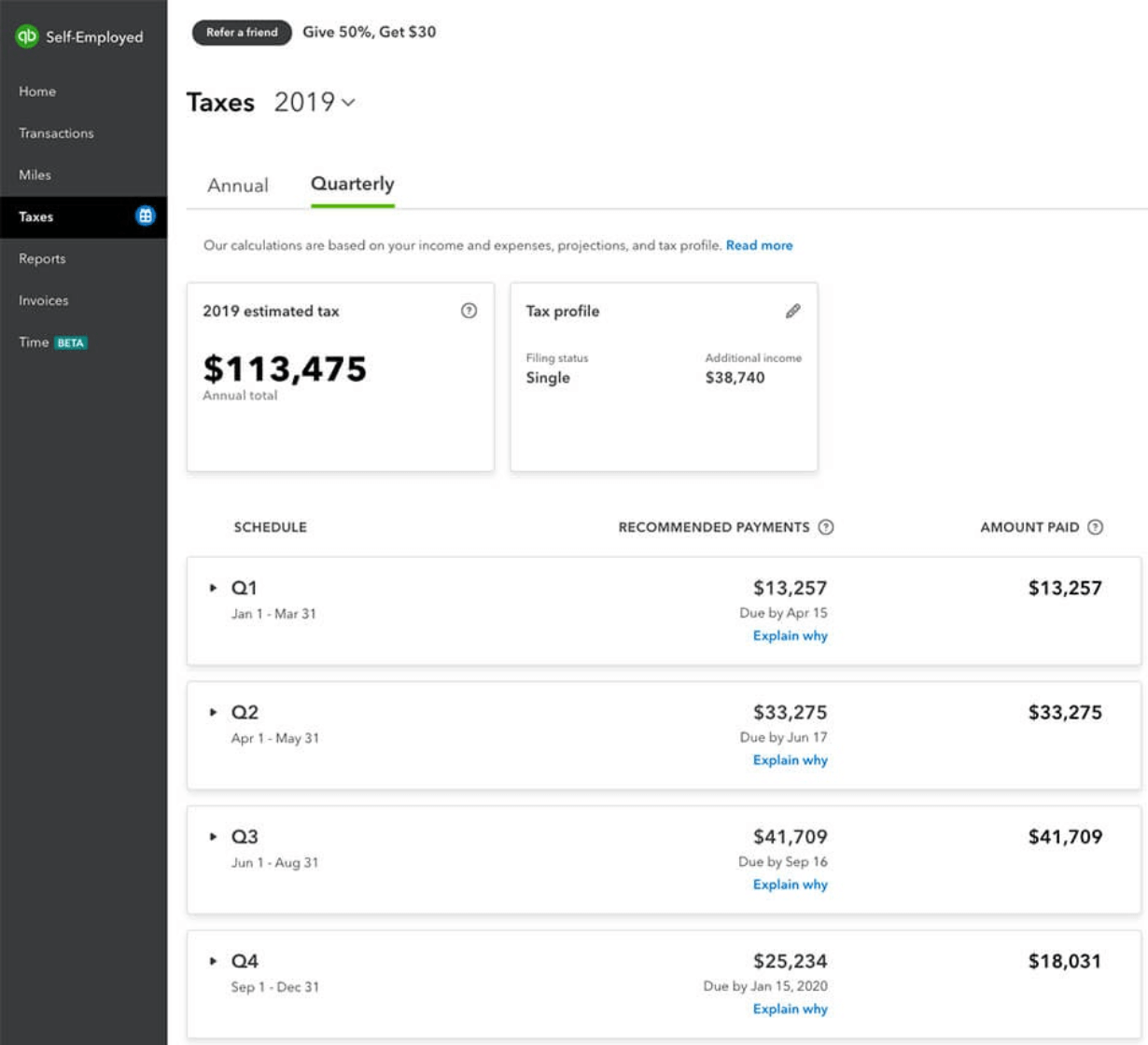

Because I use QuickBooks Self-Employed to manage the financial side of things with my blog business, they automatically calculate my estimated quarterly tax payments for me—based on my income and the way I categorize each expense. They’ll even remind me when (and how) to pay each quarter:

If online tools aren’t your thing, many small business owners opt to use a worksheet from the 1040-ES IRS form to determine the estimated quarterly taxes they’ll owe.

Usually, your estimated tax payments are split into four evenly-spaced payment periods. Your quarterlies are typically due on:

- April 15 (first quarter)

- June 15 (second quarter)

- September 15 (third quarter)

- January 15 of the following year (fourth quarter)

🚨 In 2024, the payment periods are remaining the same as usual (if you’ll recall they changed slightly in response to the COVID-19 pandemic for 2020). Estimated tax payments for Q1 are still due on April 15th.

The IRS is also offering tax relief to qualifying individuals and businesses affected by coronavirus.

Quarterly tax payments can be paid by mail, online, by phone, or with a mobile device using the IRS2Go app. I recommend their online portal.

Become Familiar with Your State and Local Tax Requirements

The 30-40% recommendation we talked about above (in terms of how much income you should set aside for tax purposes) includes your local and state estimated quarterly taxes too.

Every state and locality has different expectations for taxes, and different rates accordingly. Some areas of the U.S. will expect you to pay quarterly tax estimates for both local and state authorities—and you may receive a tax penalty if your income goes over a certain threshold and you didn’t make a quarterly payment.

Do your homework by checking out the details on what your state and county requires.

7. The 3 Best Tools to Use in Managing Your Taxes for Bloggers

Here are the tools I’ve used to help manage my own taxes as a blogger throughout the years, making the process of managing my entire business a lot simpler.

1. Sage 50cloud (Cloud Accounting Software for Bloggers and Small Businesses)

Sage 50cloud is a cloud-connected suite of accounting tools that offers a combination of remote access (from any device), intelligent reporting on your finances, and time-saving automation rules you can put in place to categorize your expenses & compile up-to-date reports anytime. Here are a few of the most useful features of Sage 50cloud:

- Easy financial reporting (quick access to current balance sheets, P&L statements, expense reports, etc.)

- Real-time financial dashboards available on desktop and mobile

- Cash flow forecasting and the ability to generate reports for your CPA to review

- Remote access from any device type, anywhere in the world

- Invoicing and fast online payment collection

- Automatically import all bank transactions and assign categorization rules

2. Quickbooks Self-Employed (My Personal Tax Tool for Bloggers)

Quickbooks Self-Employed is how I keep track of the taxes for my own blog business. It’s extremely affordable (starting at $15/mo), and it is easy to connect with your bank accounts and start using to better keep track of your income and expenses. Some of their most used features include things like:

- Separating all of your personal and business expenses

- Automatically categorizing and maximizing your deductions

- Helps with estimating your quarterly taxes

- An easy-to-use mobile app for managing your business on-the-go

- Mileage tracking (for travel and vehicle-related deductions)

Even more importantly, Quickbooks Self-Employed can also be bundled together with another flagship Intuit product—TurboTax, to make filing your taxes for bloggers that much easier when the time comes each year.

3. PayPal Business

The first thing I tell new bloggers to use to manage payments and organize their taxes is the PayPal business account. Many affiliates use PayPal to pay you, and PayPal business keeps track of many important financial documents, transaction information, and revenue data for you.

PayPal charges fees for transactions, but you can use their Business Account for free. There are no setup fees, monthly fees, or cancellation fees.

A PayPal business account allows you to operate under a business name and gives access to multiple members (if you’re starting a blog with other people). You can create & export tax documents within PayPal and even produce financial summaries for your accountant or file your own blog taxes online through a tool like TurboTax.

Bonus: Hiring a Professional

Calculating and paying taxes for bloggers can be confusing, frustrating, and even scary at times (I know, I’ve been there). Another “tool” you can use is to hire a professional to help. This is particularly important as your blog grows and makes more money.

I’d still highly recommend setting up a simple tool like Sage 50cloud or QuickBooks Self-Employed that can (at the bare minimum) keep careful track of all your income, automatically categorize your expenses and generate reports that an accountant can quickly work with.

If you need a CPA to talk with, my accountant Leo Leydon has 25+ years of experience and has been very helpful in safely maximizing the tax deductions for my business and I couldn’t recommend him more highly. 🙂

Taxes for Bloggers: Are You Ready For the Coming Tax Year?

Whether you’re a hobby blogger, side-hustle blogger, or full-time blogger… the big takeaway is to keep detailed records of your profits and expenses.

It may not feel important today to track all of your transactions if you’re making a relatively small amount each month, but even tracking the patterns will help you with your tax liabilities and help you better monitor the health of your blog business over time.

How do you keep track of your own taxes for bloggers? What are some of your favorite tools to help?

Share with us in the comments below!

Want My Free Blog Business Plan Template?

Grab my free blog business plan template in both Google Doc and PDF format (that’s helped me build a six-figure blog) and reach 500,000+ monthly readers today.

"*" indicates required fields

59 replies to “Taxes for Bloggers 101: How to Do Taxes on Your Blog Income in 2024 (Tax Tips for Bloggers)”

You are write here a guide which is very helpful for every user and your explaining method is better than others.

Nice! Glad to hear that, Vikram.

Thanks for this useful article, Ryan!

One update: the 1099-NEC https://www.irs.gov/forms-pubs/about-form-1099-nec is the new 1099-MISC.

“Form 1099-MISC, Miscellaneous Income, which is used to report rents, royalties, prizes and awards and other fixed determinable income.” – IRS.gov

Aha! Thanks for catching that, Laura 🙏

Hi Ryan! This is my first time landing on your website, and can I just say as a future blogger who is just starting off, this post was AMAZING! There is just no other type of help available that is as detailed and as easy to understand as this one. I have this page bookmarked!!!!! Thank you so much for taking the time to create this and to go into this much depth. All the backlinks were super up to date and extremely helpful. I cannot explain how beneficial this post is for anyone starting a blog! This is what other bloggers are not talking about, so FABULOUS job on your work.

Wow, thank you so much for all the kind words, Joshlynn 🙏 and I’m glad you found so much value here! Anytime you have a question I can help answer, I’m here.

Hi, this a very informative post. I thought blog income was considered passive income, much like collecting rental income from real estate property, etc. I didn’t know one would have to pay taxes as self employment. Thanks!

You’re welcome, Yash!

Very useful info, thanks

🙏

I love your website/content and all the wonderful information you provide. I’m a fairly new blogger and have just started to add Affiliate Marketing to my blog. I love your article on taxes.your content is very informative.

Thanks so much, Liza! I’m rooting for you 🙂

Hi Ryan,

Thanks for the great article! I’m looking to sign up for Quickbooks Self-Employed, and it’s showing it’s $7.50 for the first three months, and then $15 after that. Did they raise their price or do you have a special promo code to get the $1/month for the first year deal?

Thank you!

Thanks for the article! Proved very helpful and was easy to understand.

This is really true information in a appropriate way. And provided in a informative way. Keep it up ryan.

Thank you for educating us. It will help us enlighten how taxes work for bloggers. Great post!

This comprehensive guide demystifies the complexities of tax obligations for bloggers. The step-by-step approach to managing blog income taxes is both practical and reassuring.